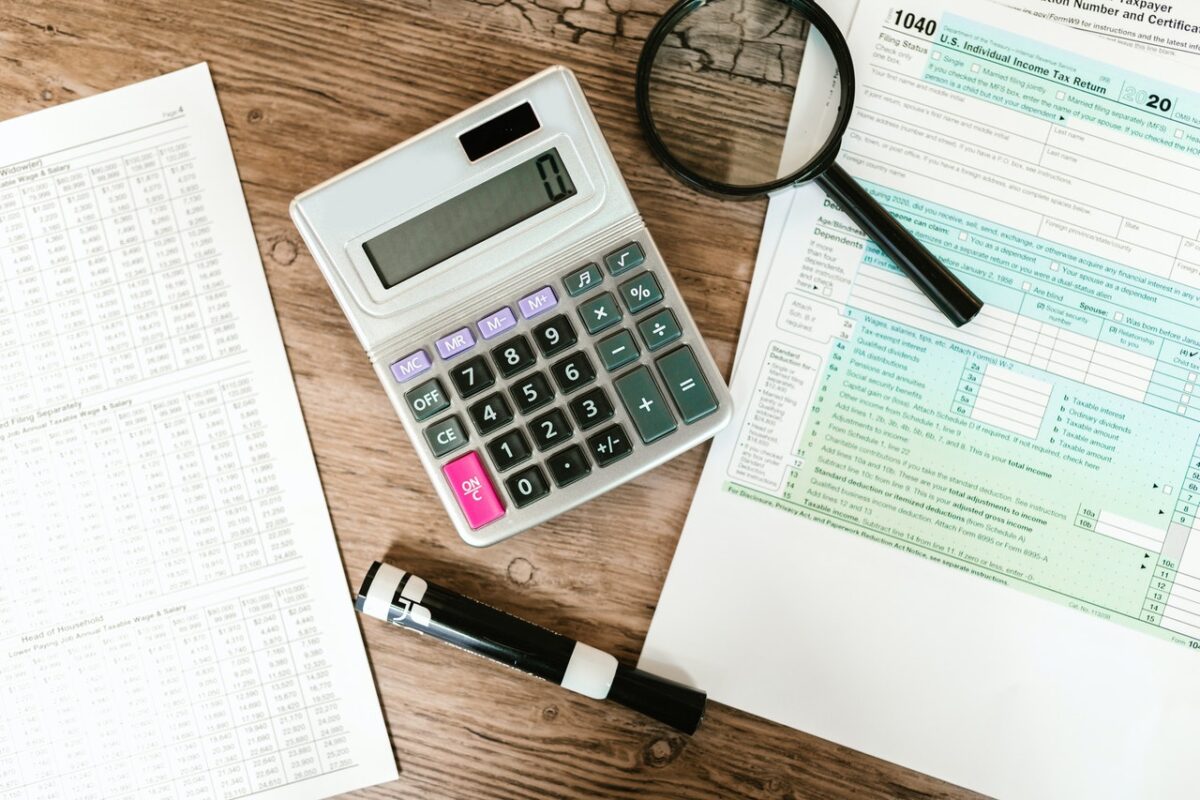

A good credit score can greatly impact the way the person is able to get a loan or the interest rate on it. In fact, a positive credit report can greatly influence the decision if you will be able to get a credit card or any other financial instrument or not. No doubt there are […]

Category Archives: Authorized User Tradelines

Your credit rating is the primary indicator that sums up your creditworthiness. Still, many people don’t realize they can improve their score until they think it’s too late — when they find out they don’t meet credit terms or turn down other services for which they are creditworthy. But it’s never too late – understanding […]

Your credit score affects everything from whether you qualify for a credit card, the interest rate offered on a car loan or mortgage, and even how much you pay on some insurance policies. Therefore, it is easy to understand why many people are looking for ways to improve their credit scores. One method people use […]

Most people opt for a personal loan when it comes to paying off debts, building a business, taking a vacation or even buying a house. But, the truth is that, a loan is not something that should be taken lightly, but something that should be thought about calmly and there are certain points to take […]

Credit cards are powerful financial tools. When used correctly, they can help manage cash flow, give you annual percentage rates for a limited time, or even help you generate cash back and other rewards. But going over your head can be a problem, and if you’re struggling to make payments, many people wonder if it’s […]

Is the bad credit card your reason for worry? Are you fed up with bad credit? We know poor credit is like a nightmare that can make life difficult. It can make you go down, and this can affect your financial status badly. But with CPN tradelines, you don’t have to think about anything. It […]

Generally the famous credit cards become a headache and an excessive expense for many people and it is often due to the misuse that is given to them and when the time comes to grab it can become a real torture. Given these circumstances, many people have reached the point of getting personal loans to […]

Having a good credit is the dream of many and the reason is that having a good credit means having access to loans and any service you may need. In this post you will be finding out if despite this you need a good credit included to open a bank account. If you have a […]

When it comes to credit misunderstandings, late payments and updating your credit report, it’s not just a one or two person issue. There are many users who deal with this issue and more and more of them are desperately looking for a solution to update or correct negative information on their credit report. It happens […]

First, you need to know what a credit utilization fee is. It is nothing more than a fee that may be charged on a secured loan or a fee that may be charged on a revolving line of credit when usage is above or below a certain amount. The borrower is usually obligated to pay […]