Credit Repair

Credit Repair Services

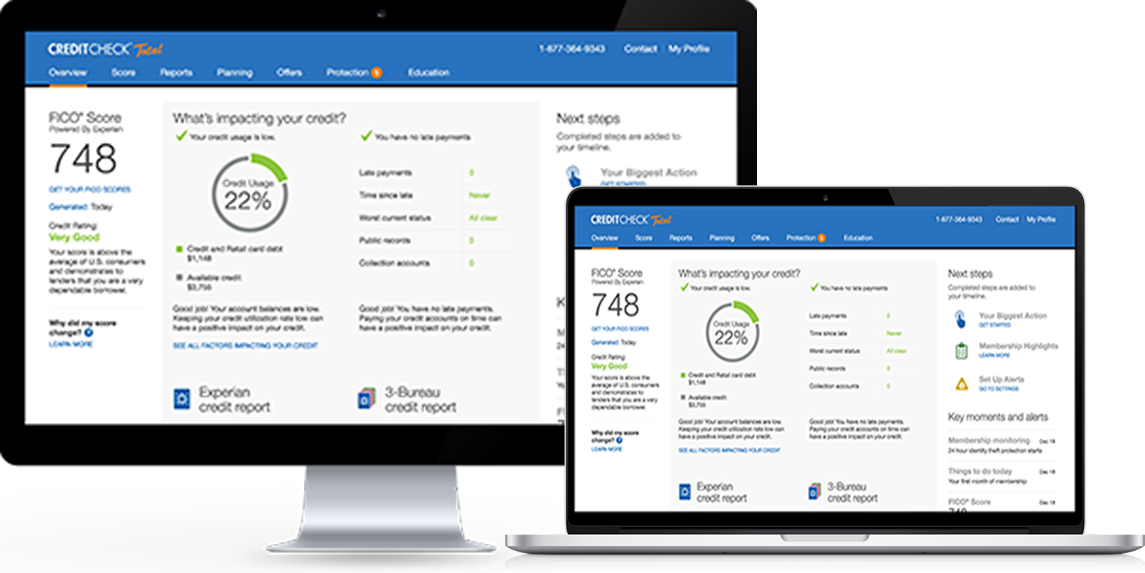

Credit repair is the process of addressing and removing the questionable negative items that are impacting your credit profile. In fact, over 40 million Americans are victims of inaccurate or unfair negative items wrongfully lowering your score. Most don’t even know, are you one of them?

As leaders in the credit repair industry, we address, attack and remove all inaccurate, obsolete & unverifiable items on your credit report. Not only do we attack and remove all negatives reported but also block them from ever reappearing on your credit life.

To remove a negative item, credit reporting agencies will require you to work through their complicated online systems and send a series of formal dispute letters. To make the disputing process easy & efficient, our Credit Repair Team will identify and challenge questionable negative items on your behalf using our patented credit repair process.

How long does credit repair take?

Unfortunately, there’s no way to predict in advance how long it will take to repair your credit, as every credit report is unique. We help thousands of people each year repair their credit, and typically they’ve stayed with us for 45 to 60 days. With our team of professionals, patented credit repair software and years of experience, our removal process is streamlined to get you fast results.

+1 (714) 594-5043

Tradelines@AuthorizedUsers.com

Which Tradeline Is Best for You?

Contact our Team of Experts so that we review your credit file and recommend the Tradeline that best boosts your Score.

We Remove All Inaccurate, Obsolete & Unverifiable Items on Your Credit Report Including

Collections

Inquiries

Late Payments

Charge Offs

Foreclosures

Bankruptcies

Student Loans

Credit Sweeps: A Complete Guide to Credit Repair

For millions of Americans, credit is the key to unlocking financial opportunity. Whether you are trying to buy a home, finance a vehicle, secure a personal or business loan, or simply qualify for a new credit card, your credit profile is at the center of the decision. Over time, however, life’s challenges can lead to negative marks such as late payments, collections, bankruptcies, repossessions, or even the impact of identity theft. That is where credit repair comes in—a process often referred to in the industry as credit sweeps.

Our company has proudly been in business for 15 years, guiding clients step-by-step through the credit restoration process. In this comprehensive description, we will explain what credit sweeps are, how they work, who uses them, and why they matter. We’ll also touch on the history of credit repair, compare interest rates between good and bad credit, highlight unique cases such as identity theft or student loans, and discuss how credit repair ties into business credit building. Finally, we’ll show the benefits of combining this service with authorized user tradelines for maximum results.

What Is Credit Repair (Also Known as Credit Sweeps)?

Credit repair is the process of challenging and removing inaccurate, unverifiable, or outdated information from your credit reports. Within the industry, this process is often called credit sweeps, because it is designed to perform a thorough “sweep” of the credit file to identify derogatory accounts and remove them legally.

Unlike do-it-yourself disputes that often drag on for years, credit sweeps are structured, strategic, and handled by professionals who understand the laws that govern credit reporting. The purpose is not to trick the system, but to hold credit bureaus and creditors accountable for reporting only accurate and verifiable information.

- What Credit Sweeps Are

- How Credit Sweeps Work

- Who Uses Credit Sweeps?

- What Credit Sweeps Are Used For

- Benefits of Cleaning and Having Good Credit

- Comparing Interest Rates: Good vs. Bad Credit

- Qualifying for Credit

Credit sweeps are a form of credit repair that focus on removing multiple derogatory accounts across all three major credit bureaus—Experian, Equifax, and TransUnion—in a streamlined and efficient process. These derogatory accounts may include:

Credit sweeps are a form of credit repair that focus on removing multiple derogatory accounts across all three major credit bureaus—Experian, Equifax, and TransUnion—in a streamlined and efficient process. These derogatory accounts may include:

- Late payments

- Charge-offs

- Collections

- Repossessions

- Medical bills

- Foreclosures

- Bankruptcies

- Judgments

By performing a complete review and challenge of the credit file, the process aims to leave the client with a clean foundation upon which positive credit can be built.

Credit sweeps work by leveraging federal consumer protection laws such as the Fair Credit Reporting Act (FCRA), the Fair Debt Collection Practices Act (FDCPA), and the Truth in Lending Act (TILA). These laws require that any item reported to a consumer’s credit file must be 100% accurate, verifiable, and timely.

Here’s a simplified breakdown of the process:

- Credit File Review – Professionals obtain all three bureau reports and perform a deep analysis of derogatory information.

- Documentation – Supporting documents are gathered, including identification, proof of residence, and any relevant supporting records.

- Disputes and Challenges – A series of customized dispute letters are crafted and sent to credit bureaus, creditors, or collection agencies.

- Verification Requirement – Bureaus and creditors are required to verify accounts within a certain timeframe. If they cannot, the items must be removed.

- Results and Updates – Clients see derogatory accounts deleted or corrected, leading to significant credit score improvements.

Credit sweeps are not a quick fix or an overnight miracle, but when handled properly, they are one of the most powerful legal tools for repairing credit.

Credit sweeps are used by a wide range of individuals across the country. Some of the most common include:

- Young professionals looking to qualify for their first home.

- Families seeking better auto loan rates.

- Business owners needing access to capital.

- Students and graduates burdened with loans but trying to establish a financial foundation.

- Victims of identity theft trying to clear fraudulent accounts.

- Individuals after major economic downturns, such as the 2008 recession or the COVID-19 pandemic.

The unifying theme is that all of these people need a clean and credible financial profile in order to move forward with their goals.

The practical uses of credit sweeps extend into almost every area of personal finance:

- Qualifying for mortgages with better interest rates.

- Securing auto loans without sky-high payments.

- Opening new credit cards with higher limits.

- Gaining approval for apartments or leases.

- Applying for business loans or credit lines.

- Lowering insurance premiums.

In essence, they are used to restore financial freedom and opportunity.

The benefits of credit sweeps are immense. Once a credit report is cleaned of inaccurate derogatory items, clients often enjoy:

- Higher credit scores.

- Better loan approvals.

- Lower interest rates, saving thousands over time.

- Peace of mind knowing their report reflects accurate information.

Increased financial confidence to pursue personal or business goals.

The difference between good and bad credit often comes down to interest rates. For example:

- A person with excellent credit may qualify for a mortgage rate of 5%.

- A person with poor credit may only qualify at 9% or higher.

On a $300,000 mortgage, that difference adds up to hundreds of dollars per month and potentially over $100,000 across the life of the loan. Auto loans, personal loans, and credit cards work the same way. This is why performing credit sweeps to achieve a higher score is so financially critical.

To qualify for credit, lenders look at three main factors:

- Credit Score – Higher scores open more doors.

- Credit History – Length, types of credit, and payment history matter.

- Debt-to-Income Ratio – Lenders want to know you can afford the new account.

By performing credit sweeps, individuals are able to clear negative accounts, strengthen their profile, and increase their likelihood of qualifying for new lines of credit.

- What Credit Sweeps Are

- How Credit Sweeps Work

- Who Uses Credit Sweeps?

- What Credit Sweeps Are Used For

- Benefits of Cleaning and Having Good Credit

- Comparing Interest Rates: Good vs. Bad Credit

- Qualifying for Credit

Credit sweeps are a form of credit repair that focus on removing multiple derogatory accounts across all three major credit bureaus—Experian, Equifax, and TransUnion—in a streamlined and efficient process. These derogatory accounts may include:

Credit sweeps are a form of credit repair that focus on removing multiple derogatory accounts across all three major credit bureaus—Experian, Equifax, and TransUnion—in a streamlined and efficient process. These derogatory accounts may include:

- Late payments

- Charge-offs

- Collections

- Repossessions

- Medical bills

- Foreclosures

- Bankruptcies

- Judgments

By performing a complete review and challenge of the credit file, the process aims to leave the client with a clean foundation upon which positive credit can be built.

Credit sweeps work by leveraging federal consumer protection laws such as the Fair Credit Reporting Act (FCRA), the Fair Debt Collection Practices Act (FDCPA), and the Truth in Lending Act (TILA). These laws require that any item reported to a consumer’s credit file must be 100% accurate, verifiable, and timely.

Here’s a simplified breakdown of the process:

- Credit File Review – Professionals obtain all three bureau reports and perform a deep analysis of derogatory information.

- Documentation – Supporting documents are gathered, including identification, proof of residence, and any relevant supporting records.

- Disputes and Challenges – A series of customized dispute letters are crafted and sent to credit bureaus, creditors, or collection agencies.

- Verification Requirement – Bureaus and creditors are required to verify accounts within a certain timeframe. If they cannot, the items must be removed.

- Results and Updates – Clients see derogatory accounts deleted or corrected, leading to significant credit score improvements.

Credit sweeps are not a quick fix or an overnight miracle, but when handled properly, they are one of the most powerful legal tools for repairing credit.

Credit sweeps are used by a wide range of individuals across the country. Some of the most common include:

- Young professionals looking to qualify for their first home.

- Families seeking better auto loan rates.

- Business owners needing access to capital.

- Students and graduates burdened with loans but trying to establish a financial foundation.

- Victims of identity theft trying to clear fraudulent accounts.

- Individuals after major economic downturns, such as the 2008 recession or the COVID-19 pandemic.

The unifying theme is that all of these people need a clean and credible financial profile in order to move forward with their goals.

The practical uses of credit sweeps extend into almost every area of personal finance:

- Qualifying for mortgages with better interest rates.

- Securing auto loans without sky-high payments.

- Opening new credit cards with higher limits.

- Gaining approval for apartments or leases.

- Applying for business loans or credit lines.

- Lowering insurance premiums.

In essence, they are used to restore financial freedom and opportunity.

The benefits of credit sweeps are immense. Once a credit report is cleaned of inaccurate derogatory items, clients often enjoy:

- Higher credit scores.

- Better loan approvals.

- Lower interest rates, saving thousands over time.

- Peace of mind knowing their report reflects accurate information.

Increased financial confidence to pursue personal or business goals.

The difference between good and bad credit often comes down to interest rates. For example:

- A person with excellent credit may qualify for a mortgage rate of 5%.

- A person with poor credit may only qualify at 9% or higher.

On a $300,000 mortgage, that difference adds up to hundreds of dollars per month and potentially over $100,000 across the life of the loan. Auto loans, personal loans, and credit cards work the same way. This is why performing credit sweeps to achieve a higher score is so financially critical.

To qualify for credit, lenders look at three main factors:

- Credit Score – Higher scores open more doors.

- Credit History – Length, types of credit, and payment history matter.

- Debt-to-Income Ratio – Lenders want to know you can afford the new account.

By performing credit sweeps, individuals are able to clear negative accounts, strengthen their profile, and increase their likelihood of qualifying for new lines of credit.

A Brief History of Credit Repair

Credit repair as an industry has existed for decades, but it gained significant traction in the 1990s as more consumers became aware of their rights under the FCRA. The rise of digital access to credit reports through online portals accelerated the growth.

After the 2008 recession, millions of Americans sought help in clearing their credit reports to recover from foreclosures, bankruptcies, and mass layoffs. Then, during the COVID-19 pandemic, another wave of financial hardship pushed credit repair into the spotlight again.

Each of these events highlighted the necessity of structured, professional credit sweeps to restore financial stability.

Legalities of Credit Sweeps

Credit sweeps are 100% legal when performed correctly. The law requires that all accounts on a credit report be accurate and verifiable. What is not legal is attempting to remove accurate, current debts through fraud or misrepresentation. Our company emphasizes compliance, ensuring that the process is conducted under the protection of the FCRA and related laws. We also ensure clients understand what can and cannot be legally removed, so expectations remain realistic.

Combining Good Credit with Business Credit

One of the most powerful strategies after completing credit sweeps is to combine personal credit restoration with business credit building. A strong personal profile makes it easier to guarantee business credit lines, which in turn opens the door to larger loans, vendor accounts, and corporate credit cards. Entrepreneurs who repair their personal credit often find it easier to launch, expand, or stabilize their business ventures. Banks and lenders are more comfortable extending credit when both personal and business scores are in good standing.

Improving Payment History:

A good payment history is one of the most important factors in your credit score calculation. By being added as an authorized user to an account with a clean payment record, you gain the benefit of that great history. This can significantly boost your credit score, especially if you don’t have many positive accounts of your own.

Quicker Results:

Unlike other methods of improving your credit score, such as applying for new credit cards or loans, adding Authorized User Tradelines can show immediate improvements. Once the tradeline reports to the credit bureaus, you may see a significant increase in your score, especially if the primary account holder has been managing their account responsibly for several years.

Credit Repair After the 2008 Recession and COVID-19 Pandemic

The 2008 recession was a turning point for credit repair. Millions of Americans faced foreclosures, job loss, and bankruptcies, creating massive demand for credit sweeps. Similarly, the COVID-19 pandemic triggered another financial crisis. Job loss, medical bills, and missed payments flooded credit files with derogatory accounts. In both cases, credit sweeps offered a way forward. By cleaning up damaged files, families were able to recover, rebuild, and regain access to housing, vehicles, and loans.

Credit Repair for Victims of Identity Theft

Identity theft is one of the fastest-growing crimes in the country. Victims often find dozens of fraudulent accounts, inquiries, and collections on their reports. Credit sweeps are essential in these cases, as they allow professionals to identify fraudulent items, document identity theft claims, and force bureaus to remove the inaccurate accounts. Without this process, victims may spend years trying to restore their financial reputation. With structured credit sweeps, recovery is much faster and more effective.

Adding Authorized User Tradelines After Credit Sweeps

Once credit sweeps have removed derogatory items, the next step is building positive history. One of the fastest ways to do this is by adding authorized user tradelines.

Authorized user tradelines involve being added to a seasoned credit card account with years of positive history. This history then appears on the client’s report, boosting their score significantly. When combined with a clean file after credit sweeps, tradelines provide an immediate enhancement that allows clients to qualify for larger loans, better credit cards, and business financing.

Our 15 Years of Experience

With over 15 years in the industry, we have helped thousands of clients achieve their financial goals. Our team walks clients through every step of the credit sweeps process, ensuring they understand their rights, their results, and their next steps. We pride ourselves on being available for questions, providing updates, and making sure every client feels supported throughout the journey.

Brokers and Resellers Are Welcome

Beyond serving individual clients, we also welcome brokers and resellers who want to partner with us. By offering credit sweeps as part of their portfolio, brokers can expand their business, add value to their clients, and benefit from our proven track record in credit repair.

Conclusion

Credit sweeps are not just about removing negative marks—they are about restoring financial dignity, creating opportunity, and building a future. From helping families recover after a recession, to guiding young professionals with student loans, to supporting entrepreneurs with business credit, the impact is wide-ranging.

With 15 years of experience, a client-first approach, and proven strategies that combine credit sweeps with authorized user tradelines, we are committed to helping every client take control of their financial life. Whether you are an individual, a family, or a broker seeking partnership, the time to act is now.

Our Team Tracks Down and Disputes Anything Hurting Your Credit Score

Click the button below to get a detailed analysis of the items that need to be removed.